The Blind Men and the Coin - Part II

In Part I of this essay I discussed The Crypto Movement and Casino. In Part II I discuss the Product and Tech.

The Product

Cuban informal cash remittance operator accepts payments in PayPay, Zelle and Bitcoin. They are unlikely to be writing about either Crypto or PayPal on Twitter.

Crypto as a Product refers to instances when people use crypto because it is the best way or only way to do something. Users of the Product don’t particularly care about the ideological baggage of the Movement. What they care about is a Product that solves whatever problem they have.

Crypto as a Product is understudied, misunderstood and underreported. One reason is that analyses of crypto as a Product are influenced too much either by:

Critics who think (or want to think) the Casino (or crime) is the whole story

Casino operators seeking narratives that place them in the best possible light.

Movement evangelists who conflate how people use crypto with how it could or should be used

Another reason why crypto as a Product is underreported is that users are incentivised to keep quiet. The main advantage of crypto as a Product is that it can be used in permissionless and censorship-resistant fashion. Hence, most of the users of the Product are using it for something that they wouldn’t get permission or would get censored for. So while members of the Movement are incentivised to talk loudly about crypto, the exact opposite is true for actual users of the Product.

Moreover, both critics and advocates keep looking for high-frequency low-volume examples of Product usage (i.e. buying coffee with bitcoin), when the reality is that it is mostly a low-frequency high-volume Product. It is underappreciated the extent to which Product use is B2B. There are a few reasons for this. First, crypto remains somewhat cumbersome to use, so some degree of specialised knowledge is needed. Second, the added complexity and volatility makes crypto mostly useful for larger transactions, which are more frequently made by businesses than individuals. In other words, crypto adoption in Nigeria is not so much people using Bitcoin to buy a latte, but rather local companies sending coins over to Alibaba vendors in China to import goods. Often the end consumer does not realise crypto rails were used to deliver the product or service they bought. The Nigerian importer that evaded bureaucrats & capital controls does not have an incentive to publicise the use of crypto, nor does the Chinese merchant that may or may not be paying taxes. Importantly, neither of them makes rushes to tell journalists that they used crypto. And why would they? They don’t make a big deal of using Gmail or Microsoft Excel either.

The users of the Product are isolated from the other elements. They are much smaller than the Casino and far less loud than the Movement. They are generally people who are disenfranchised from the global financial system, such as Cubans. Even within rich countries, the Federal Reserve found that Americans making under $25000 a year were twice more likely to use Crypto for transactional purposes than the higher income groups. Around 6% of Black Americans have used Crypto for transactional purposes compared to 1% of White Americans.

Users of the Product do not often attend crypto conferences, the same way that you would not attend a Fintech conference if you are a Wise.com or Stripe user. Anecdotally, I know of a Cuban freelancer who has been paid in (and mostly held) Bitcoin for over three years. The first Bitcoin conference in Cuba happened a few blocks away from her house last year. She had zero interest in attending. Crypto conferences are where members of the Movement and the Tech gather, with the Casino often footing the bill.

Many crypto companies are torn between serving the users of the Product and satisfying the evangelists of the Movement. Users of the Product value convenience and ease of use. The Movement favours decentralisation, self-custody and censorship-resistance. Many of the recent controversies on Twitter (such seemingly technical debates around replace-by-fee settings in Bitcoin Core, optimistic rollup sequencer decentralisation, the Ledger’s private key recovery process and the Wasabi Wallet coin control or lack of thereof ) are essentially about technical compromises between the principles of the Movement and the convenience demanded by users.

This is yet another paradox of crypto: while the Movement professes self-custody and rejects trusted third parties, an embarrassing amount of users store their assets with unreliable exchanges and custodians (think FTX). The most popular, user friendly tools often make the greatest (sometimes fatal) compromises.

Despite these drawbacks, I know crypto has found a product-market fit, because it was an essential part of my online tourism business. Crypto has found product-market fit in:

Global capital raising

Certain niches of e-commerce payments (particularly where there is high chargeback risk)

Cross-border transfers (particularly in grey or black jurisdictions)

Savings accounts (in places with little access to high quality fiat currencies)

If you are a crypto sceptic, particularly one from a wealthy nation with a stable currency, you may be wondering just how many Nigerian businesses there are that use crypto to buy things from Alibaba merchants or to hide their money from corrupt third world governments. Is this not just a crypto bro fantasy?

Not according to the IMF. Earlier this year the IMF put out a paper on crypto, saying that:

… while the supposed potential benefits from crypto assets have yet to materialize, significant risks have emerged. These include macroeconomic risks, which encompass risks to the effectiveness of monetary policy, capital flow volatility, and fiscal risks.

These aren’t just empty words on an academic paper that happens to have been published by the IMF. The IMF bail-out of Argentina came with provisions that forced the government to adopt a strong anti-crypto stance. When the IMF says that crypto poses “risks to the effectiveness of monetary policy”, what they mean is that they make things like the corralito harder to implement. According to Wikipedia, the “corralito” was:

the informal name for the economic measures taken in Argentina at the end of 2001 by Minister of Economy Domingo Cavallo in order to stop a bank run which implicated a limit of cash withdrawals of 250 ARS per week (at that time 1 USD = 1 ARS)[…] US denominated debt and deposits were forcibly exchanged for argentine pesos at 1.4 pesos per dollar for deposits and 1.0 for debt. […] After the forced exchange, people no longer had any dollars on the system and those who had savings in US dollars lost 65% of their deposited value.

In other words, Argentine depositors had their US dollar denominated deposits redenominated to be worth 65% less. The government at the time reasoned that this drastic measure was essential to stop capital flight from the country and prevent a complete meltdown of the Argentine banking system.

Whether or not this is true, the crypto-enabled vision of an egalitarian world where property rights are determined by cryptography is at odds with the ability of governments and central banks to enact this sort of policy. The IMF is taking this challenge seriously. As are the Argentines, who recently elected a strong bitcoin advocate in their primary presidential elections.

The Tech

Originally Cypherpunks knew how to write both code and essays. Satoshi himself wrote both the whitepaper and the original Bitcoin implementation. As the Movement grew, there was an increasing specialisation of labour. Those who can write and speak became evangelists for the Movement. Those that can code built the Tech.

This essay will not dwell too long on the specifics of technological achievements. It is beyond the scope of this essay to judge the contributions of crypto to cryptography or computer science. I am not the right person to comment on Robust Asychronous Schnorr Threshold Signatures or scalable zero-knowledge without trusted setups. Instead, let’s discuss the motivations of the developers and academics building and researching the space.

There are hundreds (if not thousands) of developers building crypto applications. While the field has professionalised over the last few years, many of them are volunteer open source contributors. The egalitarian, collaborative open source ethos is pervasive. I know it might be hard for cynics and critics to believe this, given the flashy lights of the Casino, but the most influential crypto developers are working on the problem either for ideological reasons, or because they find the work an interesting technical challenge. Often both!

Why is Crypto intellectually stimulating for technologists? In addition to the aforementioned ideological reasons, partly because it is the only way for hobbyists to build financial applications. Most financial applications are either closed off from the general public or highly regulated, meaning that hobbyists have little room to tinker or engage in permissionless innovation. And there is nothing that innovators love more than to tinker. Another reason why crypto captures mindshare amongst researchers and builders is that it is full of difficult unsolved problems. Satoshi set out to design and build systems designed to withstand powerful, well funded adversaries. It is much more exciting than building B2B SaaS products.

As a consequence, making money and building a Product that people use is often an afterthought. This is not unique to crypto, developers in general are guilty of this. Often they have devoted hours of time to build cathedrals that will always remain empty, never to be used for their intended purpose. The Casino can be demoralising to them. Many developers have had pangs of grief watching dog coins and ape pictures capture mindshare and users while their own innovative solutions languished unused.

At least some of the work has found uses outside of crypto. Even the most ardent critics will admit that of the deluge of money that went into crypto, at least a fraction ended up funding non-cryptocurrency related academic and applied cryptography. A recent example is the merging of a Proof of Work solution with close ties to Monero to Tor, the most widely used privacy focused browser in the world.

Yet, there are distinct advantages to this ideology and curiosity driven development. The ability to deploy a global financial contract without having to request anyone for permission is highly appealing to many developers. A recurring theme in Crypto is of technologies which were theoretical ideas in the latter half of the 20th century, such as Chaumian e-cash or automated market makers for prediction markets have been turned into productised implementations such as Cashu or Polymarket. Bitcoin itself was the productised amalgamation of earlier theoretical ideas. There’s a considerable amount of work that goes into turning theory into code. Even something as simple as sending one token to another person has significant complexity.

The Cypherpunks dreamed of a world where people used public private key cryptography to further privacy and human rights. Today, Crypto has put private keys in the hands of millions and cryptographic key management has never been easier. It does not matter that the users of private key management solutions are trading NFTs or encrypting private messages, the technical problems that need to be solved are somewhat similar. And all this has only been possible thanks to (often underappreciated and underpaid) developers.

The End ?

What is next for crypto, Movement, Casino, Product, Tech and all?

The Movement needs to ask itself: can you find a solution to political and social problems purely through cryptography? Even Satoshi does not seem to think so.

Yet perhaps from Satoshi’s perspective, crypto has already won. The populace has been granted a powerful weapon to wield against the oppressive forces of the State. Anyone in the world can send anyone in the world value over the internet. A new territory of freedom has been acquired for at least a few years and individuals have a powerful weapon at their disposal to defend themselves against overbearing states.

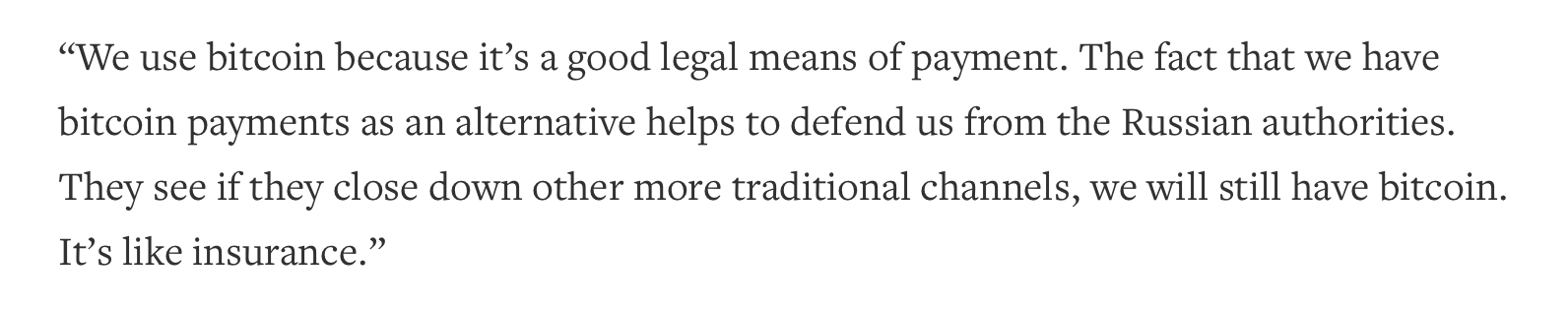

A powerful demonstration of how crypto has achieved that has come from the Russian political dissident Alexey Navaly’s chief of staff:

Importantly, this is a political victory. Political victories are not victories in the same sense that Amazon has “won” ecommerce and Google has “won’’ online search. Just because anyone in the world “can” send Bitcoin to anyone across the world doesn’t mean they do, in the same way that the legalisation of interracial or same sex marriages does not mean that everyone will be in an interracial same sex marriage. Political victories are not measured in terms of KPIs or MAUs, but in terms of acquired rights.

Both the Product and the Movement are now facing serious regulatory and political scrutiny. President Obama famously lamented that cryptography enabled everyday people to walk around with a “Swiss bank account in their pocket”. Swiss banks have of course existed for centuries, but their services are for the most part discreet, limited to rich people and an unpopular target for politicians. Despite the occasional hiccup, most Swiss banks do try not to bank the most brazen Colombian, Iranian or Russian funny money. On the other hand, due to its political origins, Crypto is boisterous and permissionless, meaning that Iranian officials can brag online about using cryptocurrencies to avoid US sanctions.

The Product enables everyday people to evade capital controls, state censorship and confiscation. From the Movement’s point of view, this is a noble form of civil disobedience. In the eyes of financiers, regulators and politicians, this is flagrantly illegal behaviour. There are Big Tech analogies of course. Uber and Airbnb were blatantly illegal for a while (and still are in some jurisdictions). But the power of taxi commissions and hotel inspectors pales in comparison to that of central bankers. Bankers and regulators may be slow and clumsy, but they are not stupid. Does this mean that a regulatory showdown is inevitable?

Satoshi knew that cryptography was never supposed to provide a permanent solution to political problems. Crypto may have won the first round, but the Leviathan of the state has now been awakened, and the crackdown on crypto will begin in earnest. Perhaps the victory was only temporary, and crypto will be crushed into irrelevance by a determined state adversary. The Casino will almost certainly be reined in by the states that are able to do so. The Casino is also the most interested in reaching a deal with the politicians, as their profit margins depend on it. Another possibility is that the Movement will have to make political compromises to partially achieve some of its goals. Or perhaps the Movement can reach a resounding victory and change the world on its own terms.

I personally believe time is on crypto’s side. Keep in mind that two of the biggest boogeymen of the Movement, modern fiat currency and the Bank Secrecy Act, are both in some sense the legacy of Richard Nixon and are thus relatively recent inventions. They are by no means some state of nature, although the underlying wish of rulers to control and devalue the money of their subjects is eternal.

Millennials, many of whom are coin owners and are keen on their digital rights, will inherit the boomer’s wealth and power in the next few decades. In the same way that the hippies and the homeowners campaign together to limit the supply of housing, the Movement and the Casino could campaign together. The idea of central banks acquiring significant Bitcoin reserves seems far fetched now, but a lot less far fetched than 5 years ago.

What is clear is that Crypto no longer exists on a theoretical plane. Whereas a few years ago it was only taken seriously by nerds on online forums, the IMF is now closely paying attention. It is widely known that Venezuelan, Turkish, Nigerian, Cuban and Argentine citizens use cryptocurrencies to escape capital controls and rapidly depreciating local currencies. Iranian trade ministers are bragging on Twitter about the use of cryptocurrencies to avoid OFAC sanctions. Bitcoin has been adopted as legal tender in a UN recognised nation state. Ransomware operators demanding Bitcoin brought the Costa Rican government to its knees. US senators and presidential candidates have widely publicised pro-bitcoin views. Even OFAC sanctions have not (yet!) been able to stop the TornadoCash smart contract from operating, even if they have deterred many potential users.

Will the four categories continue to live on as they currently exist? It might not. There is no guarantee of future success. The Movement may have to compromise to achieve its political aims. The Casino could have its wings clipped by the government and the Product may have to flee further into the underground. The Tech could easily fade into irrelevance. But no matter what your views on crypto are and how you feel about the philosophical and political currents that inspired it, keep in mind the parable of the Blind Men and the Elephant. There is often more to something than what meets the eye, particularly if it refuses to die. No matter what the future holds, Crypto has been one of the most fascinating phenomena of the 21st century.