Old Age Originations

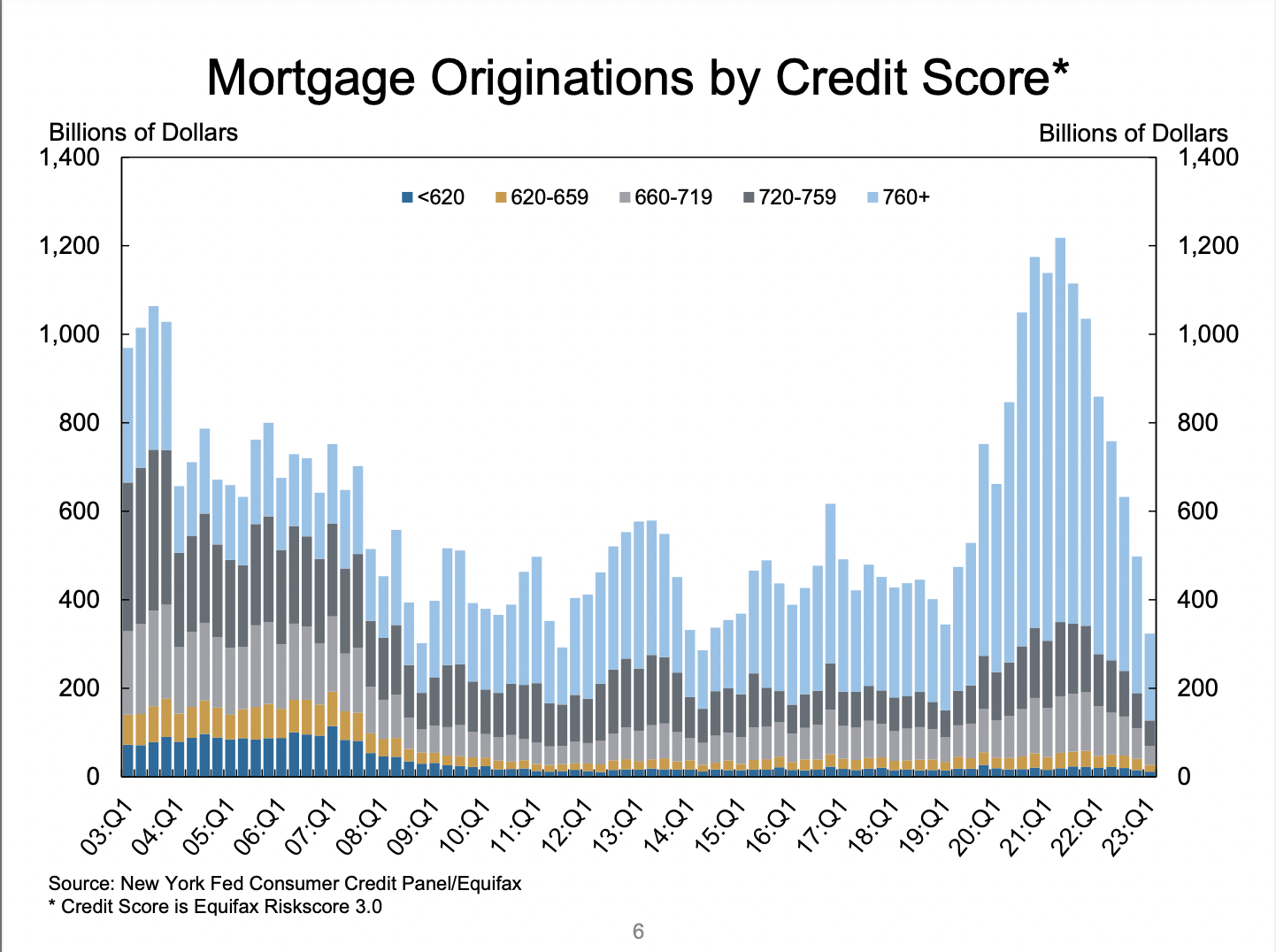

In my previous post I discussed how credit score inflation contributed to the flurry of US mortgage originations in 2020-2021. As you can see from the chart below, the scale of the mortgage boom was truly unprecedented:

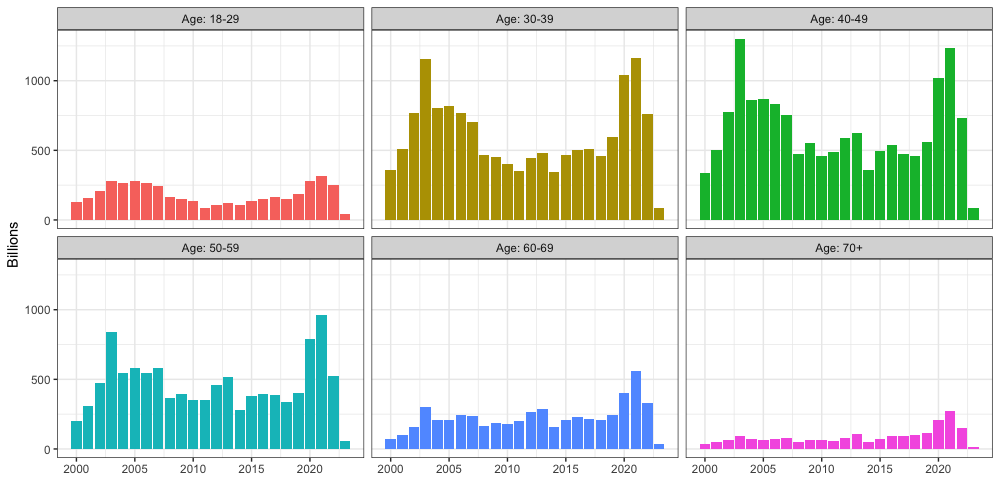

Another part of the story is the quantity of older people taking out mortgages, which was vastly higher than in any previous period. The rise of the 70+ cohort is particularly exceptional.

The vast majority of these mortgages will not be paid back by the original mortgage holder. The average mortgage term in the US is 30 years. Life expectancy at birth is 79 for women and 73 for men. Healthy men reaching 70 can expect to live till 85. Very few will make it to 100+.

Why did 70+ year olds suddenly decide to buy property on credit?

The unprecedented volumes can be partly explained by demographics. In 2003, the relatively young 70-74 year olds made up 35% of the 70+ cohort, whereas in 2021 they were closer to 39% of the group. More importantly, whereas in 2003 there were 37 million Americans 70 or above, in 2021 there were 58 million of them.

But even adjusting for population size, the average 70+ year old borrowed close to 100% more than the average 70+ year old 20 years ago. This is by far the largest change in any age group. For reference, 60-69 year olds borrowed just 2% more.

My guess is that the pandemic ushered a large cohort of well-paid 70+ year olds into retirement. These newly-retired cash-rich pensioners were looking for something to do, so they bought a holiday home. Or they were looking for yield in a time of record low interest rates, and decided that buying an extra property to rent out was the way to achieve it.

With the novelty of the new house wearing off, property price appreciation slowing down, bond markets looking increasingly attractive and rising healthcare costs, will these pensioners have a reason to sell sooner rather than later? Even if they don’t sell, within a decade or so most of these houses will be under new ownership anyway. What will these new owners do with their inherited wealth?