The Blind Men and the Coin - Part I

A group of blind men heard that a strange phenomenon, called Bitcoin, had been brought to the town, but none of them were aware of its shape and form. Out of curiosity, they said: “We must inspect and know it by touch, of which we are capable”. So, they sought it out, and when they found it they groped about it.

The first person, whose hand landed on the crypto exchanges, said, “This is like an online Casino!”. For another one whose hand reached libertarian Bitcoin believers, it seemed like a religious or political Movement. As for another person, whose hand was upon citizens of authoritarian countries evading capital controls, said Bitcoin is a Product. The blind man who placed his hand upon the cryptography papers and open source repositories, said it is a Technology.

Cryptocurrency is a controversial topic. Yet much of the debate around it is confused because, like the blind men in the parable, both advocates and critics have a myopic view of what it is.

For the purposes of this essay I’ll lump Bitcoin, utility tokens, smart contract platforms, DeFi, cryptocurrencies, web3 and NFTs into a single bucket and call it Crypto. Not because they are the same thing. They are not. But because most casual observers lump them together anyway, and this essay is for them. This greatly annoys specialists ranging from cryptographers to Bitcoin maximalists, but I will do it anyway. From the point of view of most laypeople, they are one and the same.

The main argument of this essay is that there are four distinct elements of Crypto. There is overlap between them, but often much less than people think. The elements are:

- The Casino

- The Product

- The Movement

- The Technology

Crypto critics confuse them hopelessly. A Silicon Valley developer interested in Tech will get sidelined by evangelists preaching about the Movement. Financial analysts researching the Product are blinded by the flashy lights of the Casino. But Crypto advocates aren’t much better. Members of the Movement and representatives of the Tech are to a great extent ignorant about the actual users of the Product.

My favourite example of this is in the intro of this talk (which largely inspired this essay). The talk was given at a Bitcoin conference. The CEO of Bitrefill, a company that processes 185k transactions a month from people who wish to spend their cryptocurrencies on real world items, asked the members of the audience what the most commonly used user wallets were.

Not a single person got the top one right.

If Bitcoin enthusiasts and industry insiders who go to Bitcoin conferences have no clue how users actually use Bitcoin to buy things, what hope do casual critics have of understanding what is really going on?

The Casino

The Casino is the shiniest of the bunch and the one most people are familiar with. The Casino advertises on TV, sponsors stadiums, football games and Formula 1. The Casino is huge, and almost everyone has heard of it. Casual observers often assume that that is “all there is” to Crypto.

The Casino sells the vision of “get rich quick”. It makes money on speculators buying and selling a myriad of digital tokens to each other. Its biggest players are the exchanges: Binance, Coinbase, Crypto.com, KuCoin, OpenSea and the like. They are supported by a wide range of entertainers, influencers and snake oil salesmen.

Crypto markets are an enticing product for speculators, often more so than regular financial markets, online casinos or sports gambling. Unlike the financial markets, crypto markets are open 24-7, meaning that wannabe traders, speculators and punters can conveniently trade on weekends or after working hours. In this respect, they compete with online casinos. But unlike online casinos, they are accessible to anyone in the world.

Whereas casinos often choose to limit their market exposure due to regulatory or technical constraints (your local online casino may not be capable of verifying proof of funds documents in Vietnamese or wiring winnings to a Nigerian bank account), crypto exchanges have had no such issues. For Binance, which started as a crypto only exchange, the payments problem was solved through crypto. And Binance and other exchanges have historically been very lax in letting people trade on their platform with little to no identity verification. This is now coming back to haunt them, as policy makers are imposing increasingly onerous regulation. But since the rise of decentralised exchanges in 2020, speculation is now permissionless and does not depend on a trusted third party like Binance.

And unlike casinos, the house does not always win! Sure the house takes its cut for the trades and will sometimes cheat you, but it’s more like a game of poker than a roulette table. There are a myriad of ways to become a successful crypto speculator, in the same way there are infinite ways to run a successful hedge fund. You can focus on market making and arbitrage, or perhaps stalk successful addresses on the blockchain to copy trade them, or aggregate transaction data to find patterns, or try to anticipate the latest crypto narrative (AI on the blockchain?)… The possibilities are endless. For a while, a persistently profitable strategy was to turn on notifications for Elon Musk’s Twitter posts and long Dogecoin every time he tweeted a dog meme. The rules are fluid, change over time and have brought enormous riches to those who manage to play well.

The Crypto Casino is successful because it is open 24/7 to everyone and combines the most addictive elements of choose-your-adventure massive multiplayer online role playing games with the thrilling rush of losing money.

The Casino has an ambiguous relationship with the other elements. The global infrastructure it has built is useful to the Product. It uses the language of the Movement and funds the Tech in order to give itself an air of respectability. Indeed many of the older Casino owners and operators genuinely view themselves as part of the Movement. Yet often the Casino outshines the rest. As the CEO of a non-Casino crypto company told me:

It is hard to compete with ‘get rich quick’.

Many of the important innovations of the Tech have been co-opted by the Casino. For instance, the Movement and the Tech spent a lot of time and effort, with minimal funding from the Casino, trying to rebuild the basic fundamental blocks of the financial system in a decentralised way. The Casino then discovered that this could also be used to create a MMORPG Casino, and to this day the biggest use case of Crypto is people trying to play money games with each other.

The Casino is often at odds with the Movement. Whereas the Movement professes self-custody, the casino doesn’t want you to cash out your chips. People who do not trade their coins make the Casino no money. It attracts the most attention, but is also the most vapid and contains the most insalubrious characters. These tend to be attracted to the quick money, and often disappear once the rapid price appreciations are over. In the last few years, a particularly dangerous version of the casino has emerged, where reputable looking companies like Celsius or FTX offered to take custody of your funds and packaged gambles from the Casino into safe looking instruments. They then blew up. This is a dangerous game that has hurt a myriad of retail investors, which can eventually lead to widespread regulation. Politicians can afford to look away when retail investors lose all their money on CryptoDickButts or dog coins. But it’s another issue when they lose all their money on something advertised as FDIC insured, like Voyager. A problem for crypto is that when aiming to regulate the Casino, incompetent politicians and regulators may hit the Movement, the Tech or the Product instead.

The better casino operators know that it is important for the customers to win every now and then. Slowly losing cash hurts less than being hit with a huge loss. It is no surprise that CZ, the CEO of Binance, was furious when multi-billion dollar project Luna collapsed over the course of a few days.

5. I am very disappointed with how this UST/LUNA incident was handled (or not handled) by the Terra team. We requested their team to restore the network, burn the extra minted LUNA, and recover the UST peg. So far, we have not gotten any positive response, or much response at all

— CZ 🔶 Binance (@cz_binance) May 13, 2022

Fortunately for crypto, regulating the Casino is incredibly unpopular with the patrons. Given that it’s built on top of technology designed to be censorship resistant, I do not see a world where the crypto Casino gets regulated to death. Certain insalubrious elements will be repressed, but politicians and regulators do not want to push the Casino further underground. Authorities like to be able to call exchange operators to ask for favours and enforcement. They will, however, start insisting that they pay more taxes.

The Casino is particularly hated by economists, traditional finance and tech professionals because it makes a mockery of them. It uses their language and mimics their institutions to build and promote brazenly speculative, zero-sum games. A far greater share of Wall Street and Silicon Valley is about speculative zero-sum games than the industry insiders care to admit, and the crypto Casino holds a mirror to this reality. Nevertheless, crypto Casino is likely going to continue to gain market share on legacy casinos, legacy securities exchanges and other traditional places of gambling and speculation over the next few years. The biggest threat for the Casino is that people’s appetite for speculation abates over the next few years. But why would people stop buying dog money?

The Movement

But, you may ask yourself, what accidents of history have led to people buying digital ledger entries representing dog money in the first place?

It starts with the 2008 Great Financial Crisis. The consequences of the crisis can still be felt today across the West. In the UK, productivity growth and electricity consumption stalled in 2008. In the US, birth rates broke and haven’t recovered.

Across the political spectrum, people were outraged that bankers seemed to manage to socialise losses while keeping the gains to themselves. While Main Street was getting evicted, Wall Street was getting bonuses. Several movements sprung out, such as Occupy Wall Street and the Tea Party. Most of the movements that were born out of the Great Financial Crisis have since withered away. Yet the crypto Movement that was born with Bitcoin is thriving. In fact:

Crypto is the single most successful global political movement to surge in the last decade.

Crypto has been a social and political Movement from day one. The first Bitcoin block, mined in January 2009, contains the following newspaper headline etched into it:

Chancellor on Brink of Second Bailout for Banks.

This political nature of the Movement is worth belabouring, because it hopelessly confuses Financial Times readers who cannot go beyond the mental models of EBITDA and cash flows. It bewilders the Web2 types that read TechCrunch, who are used to thinking in terms of MAUs and conversion funnels. But it also confuses many Politico readers, who either superficially assume the entire Movement is just a front for the Casino or are hoodwinked by the jargon into believing it is apolitical.

Ever wonder why Crypto refuses to die despite the predictions of economists, tech commentators and other self-proclaimed experts? Surely, if it was a pure ponzi scheme it would have fizzled out by now? If it were useless, why is there more mindshare on crypto than ever? Why is it that every time it is pronounced dead, it comes back stronger? It is because there are thousands of smart and passionate individuals across the world that selflessly dedicate themselves to the Movement.

The individuals that form the core of the Movement are not in it for the money. They are philosophically, socially and politically aligned with Crypto.

Satoshi Nakamoto, the pseudonymous founder of bitcoin, seems to not have cashed out a single dime. The core developers of the two largest protocols, Bitcoin and Ethereum, are notoriously underpaid compared to what they could make in the industry or even working for FAANGs. Even Vitalik Buterin, the well-known multi-millionaire founder of Ethereum, lives a famously ascetic life. Throughout the world, meet-ups, educational material and classes are organised by enthusiastic underpaid individuals like Andreas Antonopulous who have little financial interest in doing so.

Understanding Crypto as a social and political Movement is eye-opening. It can explain the tribalism of different Crypto factions, the zealousness, the evangelism, the callous indifference towards facts of many tribe members and high priests. But it can also explain the selflessness, the sense of community, the mutual support and sincere belief in the cause. If you pay attention, you will quickly notice the ubiquitous political, utopian, and pseudo-religious language of many Crypto enthusiasts.

Online arguments about Crypto make about as much sense as political or religious arguments. People’s minds are made, and the same way that some people will vote for the same political party for their entire lives no matter what they do, some people will put 10% of their paycheck into Bitcoin every single month no matter what. This is true for both advocates and critics. Many “refutations” of crypto from “technology experts” or “economists” essentially boil down to “I disagree with the political values this implies.”

But what are these political values? It is a Movement that is disillusioned with existing institutions. It believes that these institutions are inherently flawed and impossible to reform. The only alternative is to use technology and cryptography to build a better system from the ground up.

In Satoshi’s words:

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. - Satoshi Nakamoto

The aim is to design an open and transparent world where individuals are free from the burden of government oppression. Property rights and ownership are to be determined by the mathematics backing public key cryptography, not biassed courts and corrupt politicians. It is a vision of an egalitarian, open and transparent system where all rules are enforced equally, where big banks are just as likely to get foreclosed as homeowners. A world where anyone in the world can interact economically with anyone in the world, without interference from the state and with minimal risk of confiscation.

Like all social and political movements, it is fraught with contradictions. Crypto is highly individualist, in the sense that it encourages self-reliance and independence from “trusted third parties”. It places a strong emphasis on the rights of the individual versus the tyranny of the collective. But there is a powerful collectivist voluntarism to it too, which stems from the desire to build new and better institutions. Bitcoiners build communes around the world, such as Bitcoin Beach and Bitcoin Jungle. These can grow to have significant political influence, such as in El Salvador. Ethereans have been obsessed with Decentralised Autonomous Organisations (DAOs) since day one, which are a rebranding of cooperatives for the digital age.

Another of the Movement’s many contradictions is that utopian idealism is married to cynicism. While a lot of the essential critical crypto infrastructure is built and maintained by selfless believers, it also assumes that “rational” individuals are greedy and motivated by self-interest. There is a powerful school of nihilism that believes that all human institutions and values are flawed and self-serving. In simple terms:

Everything is a scam.

This is professed by crypto thinkers from multiple different tribes, ranging from the Bitcoin Maximalist Bitstein to so-called Profit Maximalist Degen Spartan. This cynicism often does not spare crypto itself. As some crypto proponents put it: “Yes crypto is a scam, but everything else is a scam too, and at least crypto is OUR scam”.

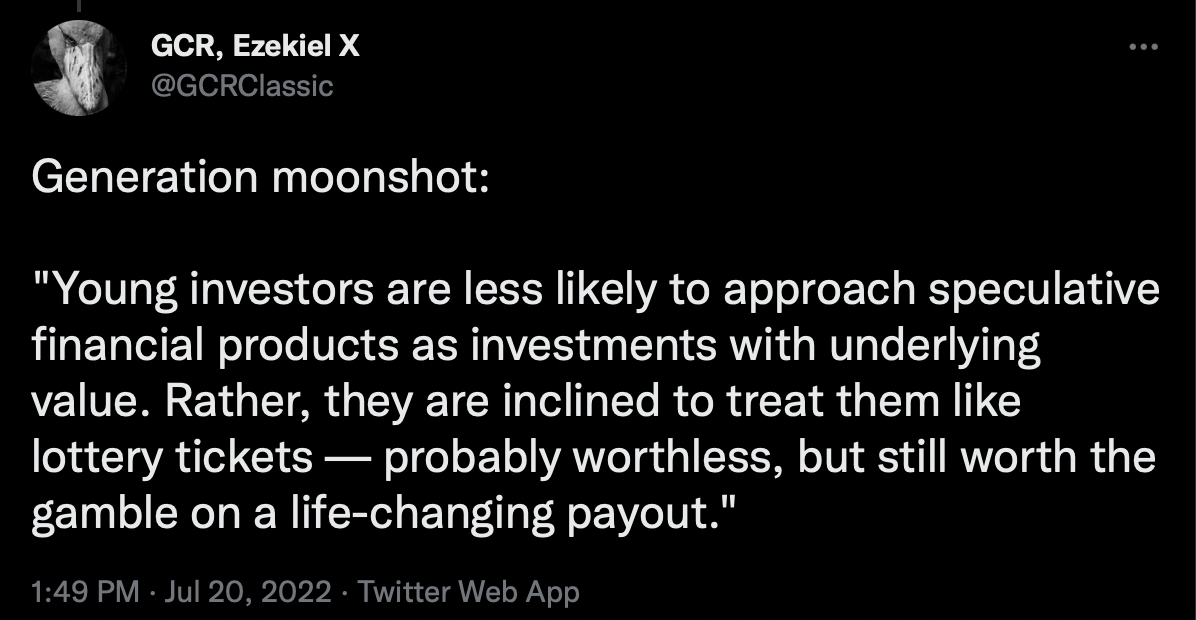

A philosophy of cynicism and disillusionment has fallen upon fertile ears in the youth. Baby boomers are a numerous generation. They are living and working for longer than any generation before. In the developed world, young people have been pushed out of the arts, corporate careers, politics, science by this demographic trend. Young people have been priced out of the housing market and the legacy financial markets. The majority of Brits born after 1991 have lost in every single election they voted in. Young people spend up to 30% of their gross income on rent, receive increasingly less government assistance and increasingly higher taxes.

In much of the rich world, young people don’t vote because they’ve never seen it work, they don’t save money because they are priced out of housing and starting a family. They don’t even believe in taxes and wealth redistribution. The benefits go to the old and rich majority of the electorate while taking from the young and poor. Facing underwhelming prospects professionally and politically, too poor to raise a family and too boring to party, young people increasingly have retreated to the virtual world they feel comfortable in. This can be gaming, gambling and social media, but also Crypto.

This favours both the Casino and the Movement. Virtual escapism has been acknowledged as a key factor by both CZ, the owner of the largest crypto exchange, and GCR, a successful political forecaster and crypto trader. An inability to accumulate capital makes people willing to punt with the little capital they have on dog coins. An inability to influence institutions through traditional politics gives young people an incentive to build a Movement that builds around it.

Yet the virtual escapism, nihilism and cynicism do not eclipse the inherent optimism and idealism required of those who set out to change the world. Despite the cynicism, there is a strong belief that the world can be a better place, coupled with a vision of how to achieve it. No matter how vague or fraught with contradictions this vision can be, it is a vision that has persisted and grown from the fringe to the mainstream. Other than crypto conferences, where else do young people gather to imagine what a better world could look like?

See Part II for the answer.