Are we living in an advertising economy?

If the economy is struggling, why are stocks at all time highs? Advertising! (And AI but lets ignore that for now).

During Covid years, consumers suddenly became cash rich. They got generous government transfers and couldn’t spend money on going out. They paid down their debts and bought goods & services online.

Once they realised consumers had money to spend and were willing to spend it, companies started raising their prices to improve their margins. They did so regardless of whether they were impacted by any inflationary pressures. Consumers were happy to pay it… until…

At some point consumers started running out of money. What do people do when they want to spend money they don’t have? They borrow it. Keep in mind the sudden cash transfers inflated consumer’s credit scores, so lenders were willing to lend.

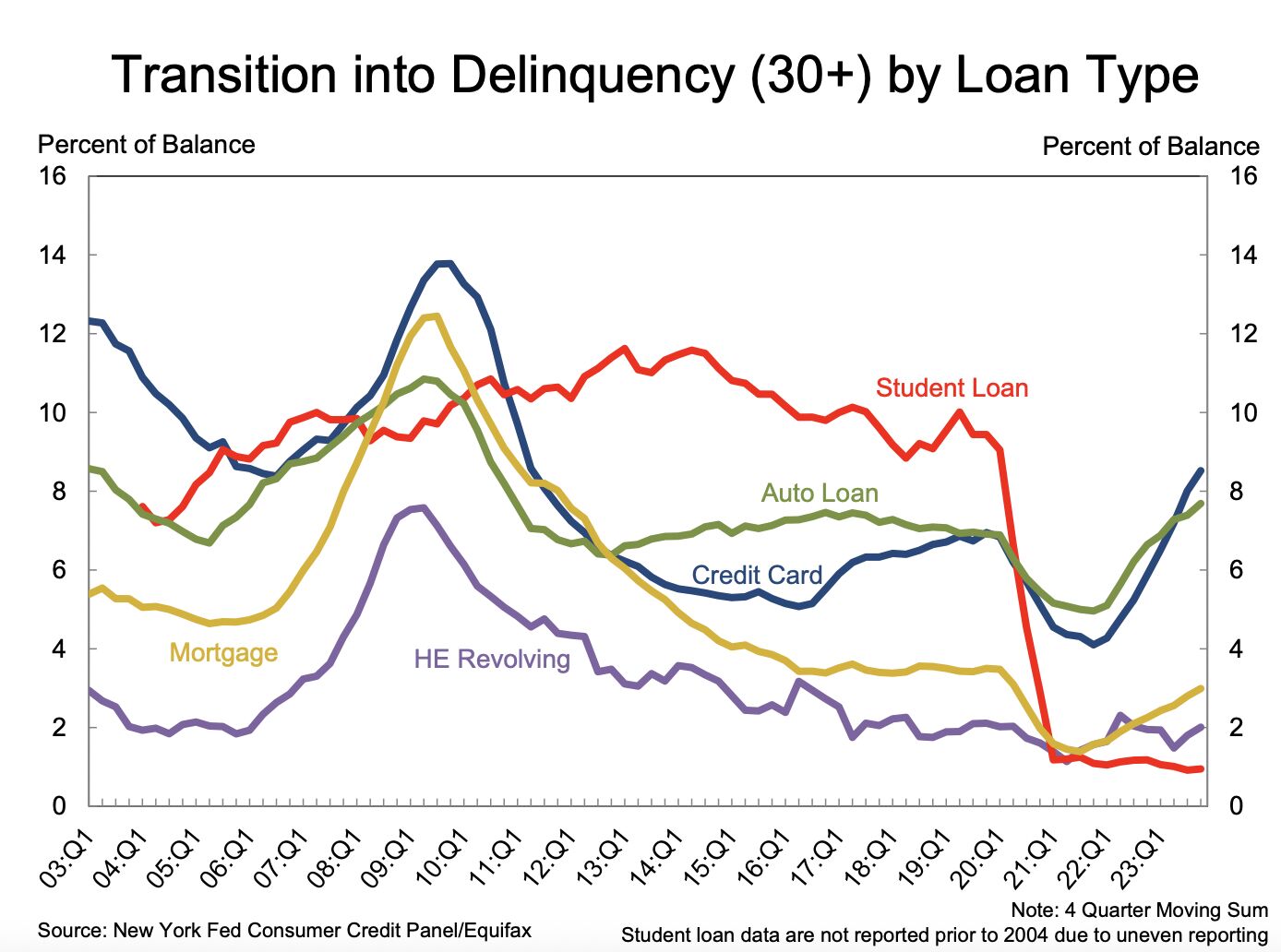

But now, credit card delinquencies in the US are at levels not seen for 10 years.

The Federal Reserve Bank of New York recently put out the household debt and credit report. One worrying fact: delinquencies seem to be on the rise, particularly in the credit card and auto loans markets.

Young Americans in particular are having trouble paying off their credit card bills and auto loans. This is a segment that likes to use novel forms of consumer credit that do not report back to credit bureaus, like BNPL. Meaning that the overall picture may be even worse.

A lot of people (and lenders!) overextended themselves during the Covid stimulus era and are now facing the consequences. Lenders are getting skittish, and consumers can’t borrow cheaply and easily anymore.

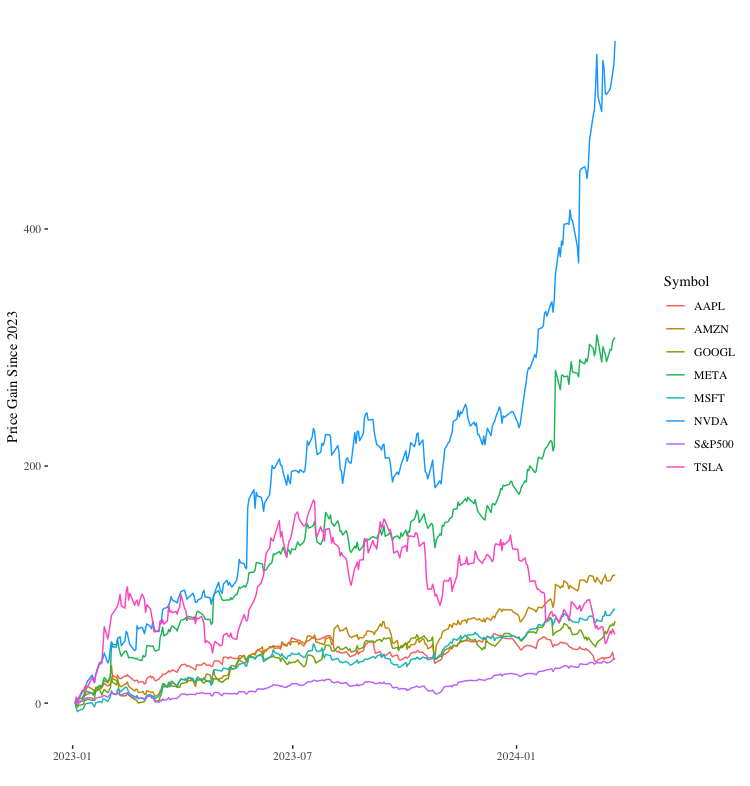

You can see it in the stock market too. Most company share prices are flat, with only a few names like Amazon (AMZN), Meta (META), Microsoft (MSFT), and NVIDIA (NVDA) doing most of the heavy lifting.

Indeed, even within companies advertising has grown the most. Last year Apple’s product revenue was flat but their services revenues (effectively in-app sales and advertising) grew 10 %. Amazon’s ad business grew 27%, its fastest growing segment. Meta’s revenue, which is almost exclusively dependent on advertising, grew 25%. Even Uber is now in the advertising business!

The AI boom also depends to a great extent on advertisers. Meta is one of NVIDIA’s largest clients.

In summary, companies are failing to grow revenues, and are investing in advertising in an effort to do so. If the increased advertising doesn’t in fact lead to more sales, companies will be forced to cut costs further and increase layoffs. That could spell trouble for the wider economy.