A quick view at P2P trading volumes on BISQ

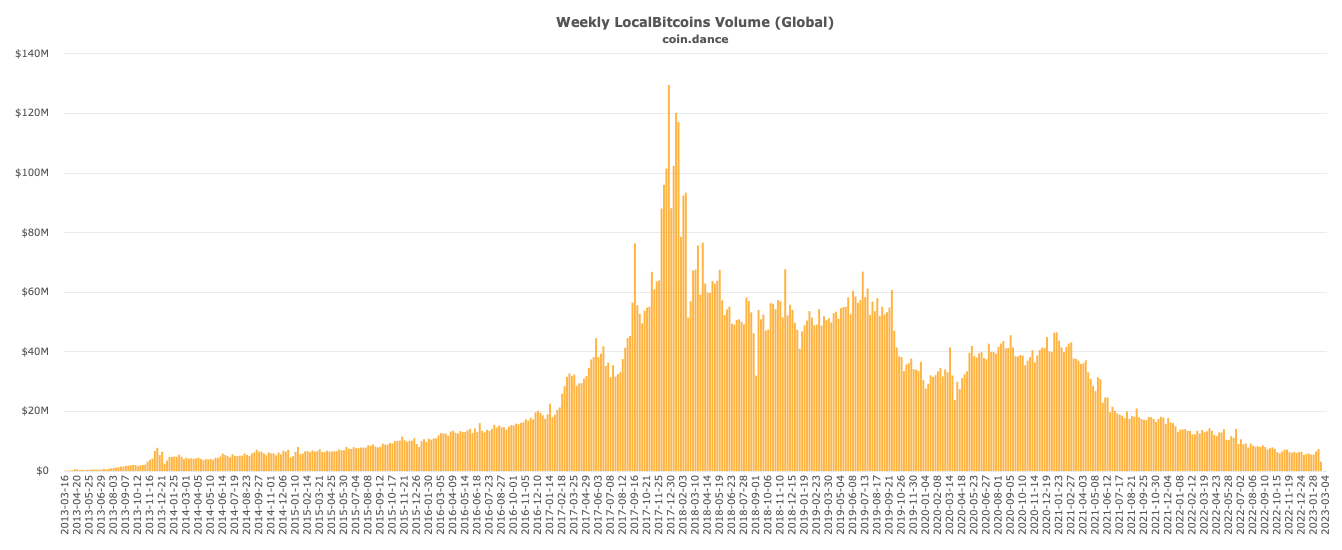

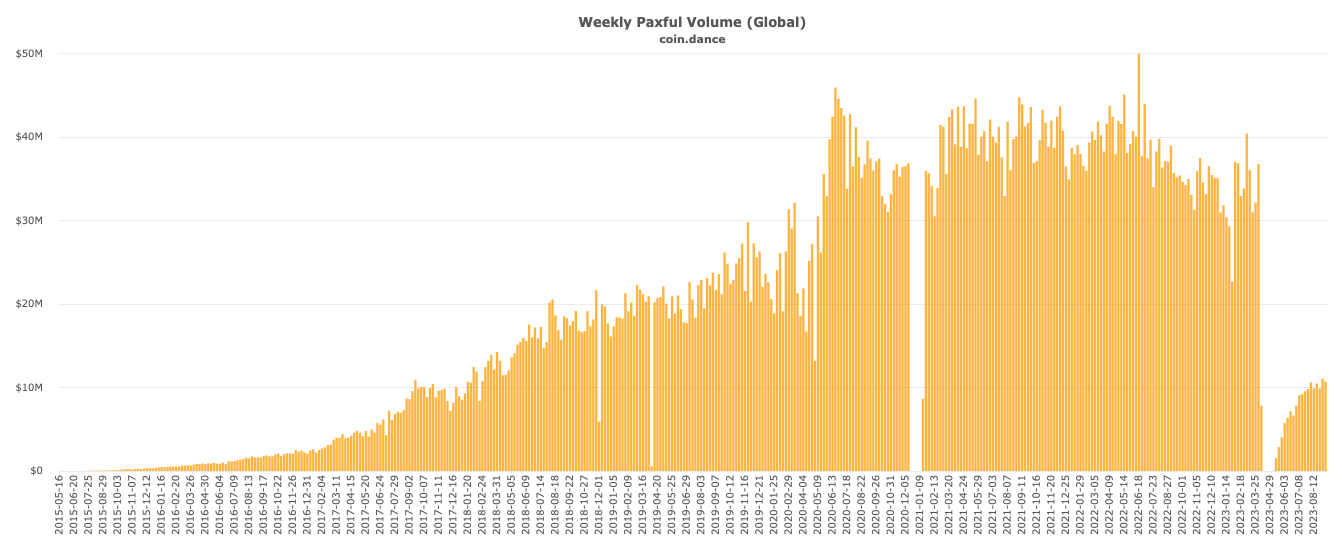

Crypto newbies seem to forget that the original way to buy bitcoin was through peer-to-peer trading on sites like LocalBitcoins. At a time when the fall of FTX and the rise of blockchain surveillance companies like @chainalysis highlighted the risks of centralised exchanges, P2P markets have failed to capitalise on the opportunity. In fact, the P2P market has suffered a lot of changes recently, with the shutting down of @LocalBitcoins, the management turbulence around @raycivkit’s resignation at @paxful.

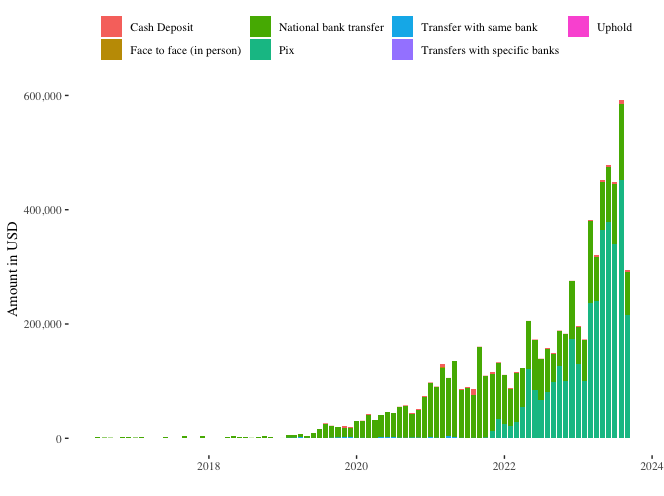

This is evident from the volumes they report too:

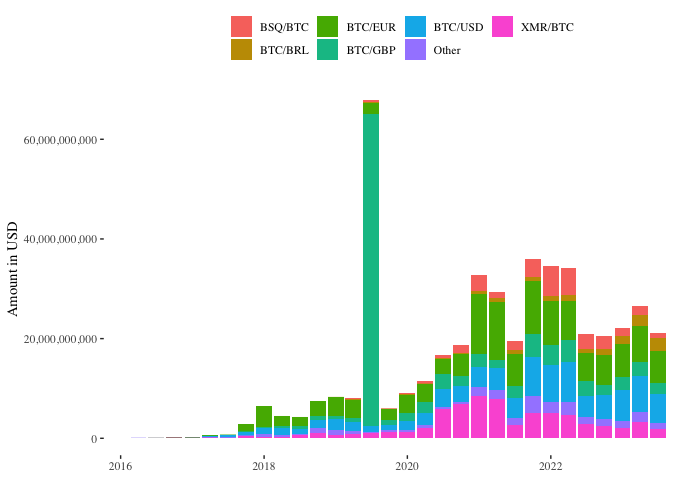

Unfortunately, market leader @binance does not publish volume data about their P2P market, so it’s hard to know whether they’ve managed to capture all the market share the other two have lost. So I’ve been digging around the @bisq_network trade data, which is a smaller, more decentralised alternative. A few interesting trends stand out. First, Bisq is still generating around $20m in volume a quarter, which is not insignificant given the considerable friction of trading on BISQ. The most important pair is $XMR, suggesting that BISQ is used for obfuscation more than fiat onboarding/offboarding.

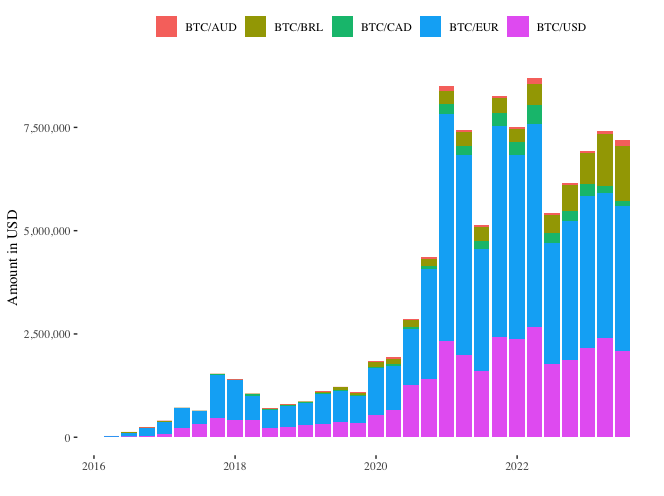

Second, the volumes for the main fiat pairs are indeed growing, albeit at a much reduced pace. This suggests that the demand for non-surveilled fiat on and off-ramps is indeed rising. Moreover, the most stunning growth is in the BTC/BRL pair.

Payments nerds like @jp_koning will be interested to hear that much of the growth in Bisq’s volumes on the BRL pair are indeed thanks to the phenomenal success of PIX, the Brazilian central bank’s new payments system.

Brazilians have been buying and selling BTC to the tune of $1m a quarter using PIX, and the growth seems to continue.